Eight ways to waste your money

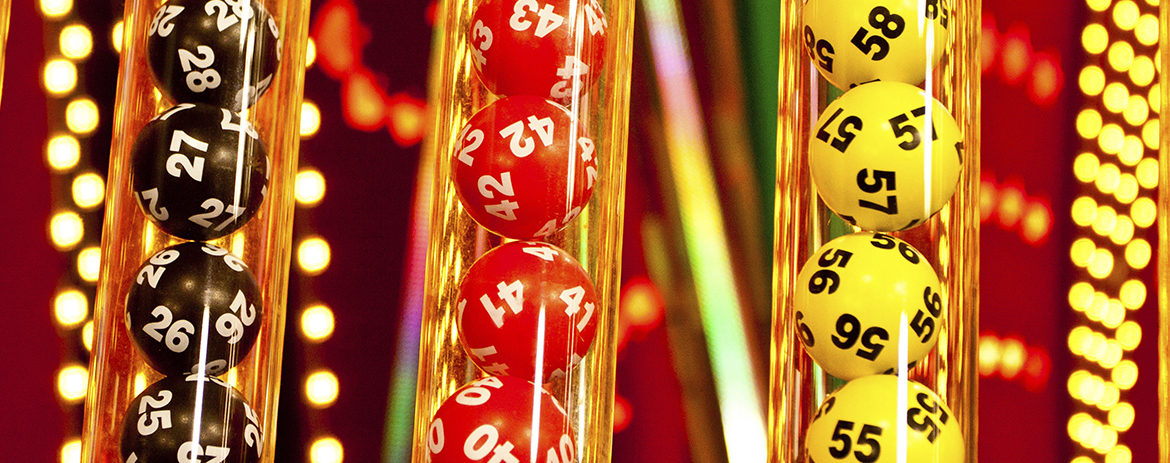

We all throw money down the gurgler. But some Kiwis have far higher chances of getting a Darwin Award for stupidity by paying too much idiot tax than others. Technically ‘idiot tax’ is spending on Lotto. Your odds of winning Powerball in New Zealand are 1 in 38 million per line. Yet the same money invested in a KiwiSaver growth fund from the age of 25 to 65 would add up to $128,000 after tax. Stop wasting your hard-earned money…

read more