Here’s what a credit report actually looks like

If you’ve ever wondered what your credit report looks like, wonder no more. This guide will give you insight into your credit report, including what information it contains, how to read it, and why it’s so important.

There are three main credit reporting bureaus in Australia, and you can access their version of your report in a number of ways, including in a written/physical format or through an online dashboard.

Each variation may differ slightly in the way it’s presented, but the bulk of the information will be the similar. For this guide, we’ll be using the convenient (and free!) Credit Simple online credit report dashboard to explain what your credit report contains.

Credit Simple gets its data from the credit reporting bureau illion.

Your credit score

When you first login to Credit Simple, you will see your credit score. This is a reflection of your credit-worthiness boiled down from a heap of lending data into a simple number.

Your credit score and score trend

illion scores range from 0 – 1,000 and the higher the score, the more creditworthy you’re determined to be.

Here’s how the scores break down:

- Score of 0. This is the lowest score you can get and means you’re the riskiest kind of borrower. People with a score of zero either don’t have a credit history at all or have experienced a very negative credit event like bankruptcy.

- 1-499. You have a below-average score and are considered very risky to lend to.

- 500-699. You have an average score and with a few small changes to your borrowing behaviour, you could easily improve your score.

- 700-799. You have a good score and lenders are likely to give you favourable treatment. However, you may want to limit the number of applications you make, as this is what is likely keeping you from having an excellent score.

- 800-1000. You have an excellent credit rating and are considered the least risky to lend to. This puts you in a great negotiating position with lenders.

Your credit history

Your credit score isn’t a magic number that is pulled out of thin air. It is the result of a calculation that incorporates heaps of data around your borrowing habits. The data that your credit score pulls from is called your credit history.

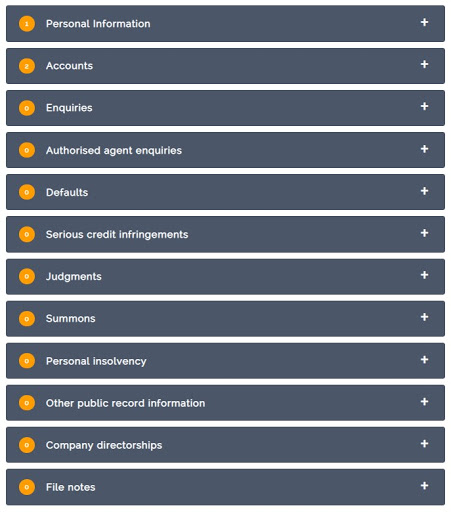

Credit Simple also provides your credit history, broken down into the following categories:

- Personal information. Your name, date of birth, address and previous address.

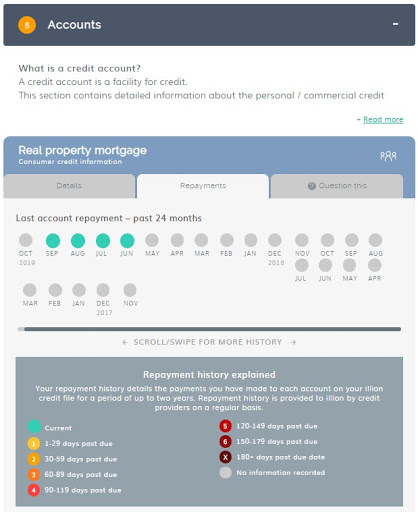

- Accounts. The accounts you have open including mortgages, credit cards, utility accounts and even equipment hire. It also includes details like the amount you owe and a complete breakdown of your payment history.

- Enquiries. The times you’ve authorised a lender or a utility to do a hard enquiry into your credit history (a hard enquiry is an official inquiry related to an application for a loan). Looking at your own credit history (soft enquiry) won’t decrease your score, but too many hard enquiries can lead to a small deduction.

- Authorised agent enquiries. The times you’ve allowed an authorised agent, such as a mortgage broker or a car dealer, to do a credit enquiry on your behalf.

- Defaults. Any payments that are at least 60 days overdue (or were at least 60 days overdue at the time of payment).

- Serious credit infringements. Situations where a lender believes you fraudulently tried to obtain credit or tried to fraudulently avoid your credit obligations.

- Judgements and Summons. Publicly available court records pertaining to your debts.

- Personal insolvency. Publicly available data from the Australian Financial Security Authority related to bankruptcy.

- Other public record information. Other publicly available information that may be useful to potential creditors when determining your creditworthiness.

- Company directorships. Publicly available information from the Australian Securities and Investment Commission about any previous or current directorships you’ve held in any company.

- File notes. Notes placed on your credit history (at your request) explaining or disputing the circumstances surrounding information on your report.

Here’s what it looks like in the tool:

The categories of reporting in your credit report.

You can expand each section to see much more detail about each. Here we are looking at payment history of a specific account listed in the accounts section:

A detailed repayment history for an example account

What can you do with this information?

As you can see, a credit report is quite straightforward although it can contain quite a bit of information. The good thing about a tool like Credit Simple is that it allows you to have all of this information at your fingertips and dig through it systematically.

Going through your report with a fine-tooth comb can help you in a number of ways. You can:

- Identify areas where you could improve. If you see that late payments are hurting your score more than you thought they were, it’s likely to propel you to make changes.

- Identify errors in your report. If you see something reported that you dispute, you can bring this up with the lender or the credit bureau. Credit Simple lets you lodge a dispute right through the tool.

- Negotiate better terms. If you see that you have a good score, you can have more confidence in negotiating with your lender for better terms like lower interest rates and reduced fees.

The information in this blog post is general in nature and does not constitute personal financial or professional advice. It is not intended to address the circumstances of any particular individual. We do not guarantee the accuracy and completeness of the information and you should not rely on it. Before making any decisions, it is important for you to consider your personal situation, make independent enquiries and seek appropriate tax, legal and other professional advice.

Credit Simple

Credit Simple gives all Kiwis free access to their credit score, as well as their detailed credit report. See how your credit score compares by age, gender and community and gain valuable insights into what it all means.

All stories by: Credit Simple